ACP Member Ed Fulbright, CPA, CGMA, PFS, wrote Why Knowing Your Tax Rate Is Importantant for the Spring 2015 Financial Focus. There is a lot of information to digest in his article so we have split it up into four blog posts. Please continue reading to learn Ed's step one of simplifying and lowering your taxes.

Why Knowing Your Tax Rate Is Important

By Ed Fulbright, CPA, CGMA, PFS

Durham, NC

Do you like paying more taxes? If not, then understanding your income tax rate can help. Some people believe that can be as complicated as picking your NCAA tournament brackets. It is not. Here is my four-step process to simplify and pay lower taxes.

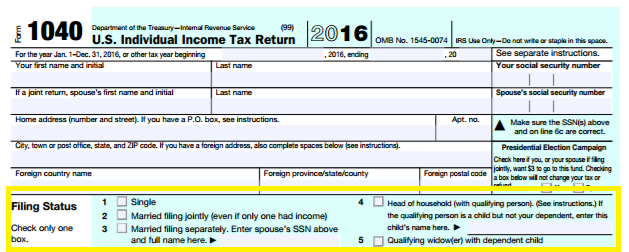

Step One: Understand your filing status, which can be:

1. Single (S)

2. Married Filing Jointly (MFJ)

3. Married Filing Separately (MFS)

4. Head of Household (HOH)

5. Qualifying Widow(er) with Dependent Child

Changes in your filing status can result in major changes to your taxes owed. I find that couples who married in the previous year are often surprised when they file their tax return together. Two people who are both in 25% and higher brackets as Single may owe more taxes when they file jointly (MFJ). This is called the marriage penalty tax. To know what your marriage penalty is, visit http://calc.taxpolicycenter.org/marriagepenaltycalculator/ or call your financial planner. On the other hand, you may pay lower taxes after you marry and file MFJ if one spouse has significantly higher income than the other. In event of divorce or separation, you may qualify for Head of Household status (HOH). Normally you qualify as HOH when you have a child and/or certain other dependents. Filing your return using HOH status will lower your taxes more than filing using Single status.

Stay tuned for Steps Two through Four!